Non Spouse Inherited Ira Rules 2025. Under this option, the inherited ira remains in. This way, you can change the amount you withdraw based on your income to.

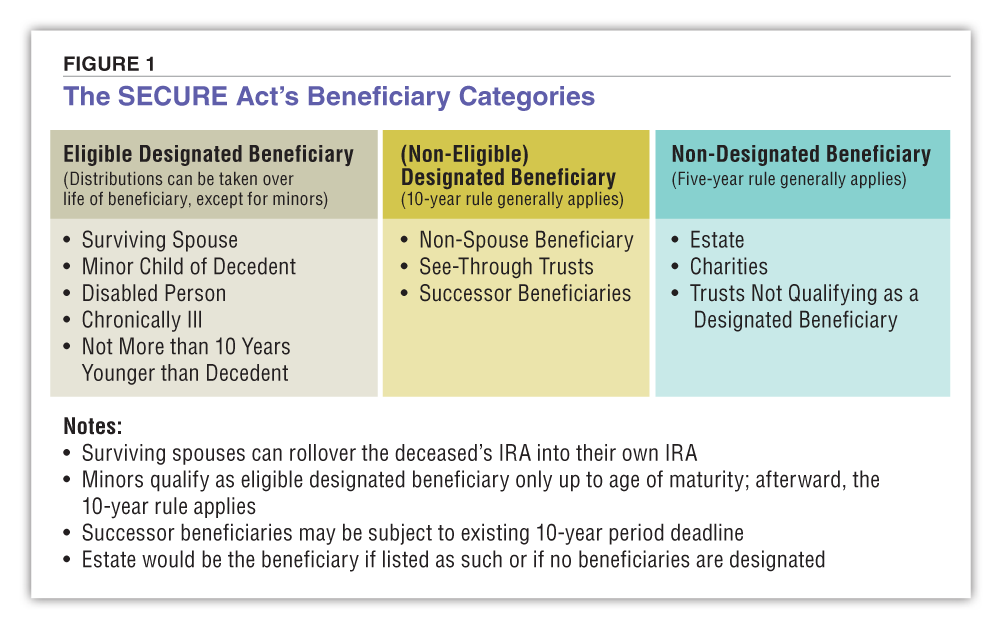

When someone bequeaths an ira to you, it’s essential to adhere to the irs inherited ira 10 year rule. Can treat the ira as their own or as an inherited ira.

If you inherit a traditional, rollover, sep, or simple ira from a spouse, you have several options, depending on whether your spouse died before or after their required beginning.

Inherited Roth Ira Rules 2025 Pen Leanor, 1, 2025, must empty the account within 10 years of the account owner’s death. If you're not a spouse or an edb, then generally you must distribute all assets from the inherited ira within 10 years of the original owner's death.

Inherited Ira Rules 2025 Perla Kristien, This way, you can change the amount you withdraw based on your income to. Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended.

New Inherited Ira Rules 2025 Donna Gayleen, The irs seems committed to offering. If you're not a spouse or an edb, then generally you must distribute all assets from the inherited ira within 10 years of the original owner's death.

How Do Inherited IRA's Work For NonSpouse Beneficiaries New Rules, Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended. More on this can be.

New Rules For Inherited Iras 2025 Merl Stormy, Here's what you need to know. Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended.

IRA Inheritance NonSpouse IRA Beneficiary Fidelity Ira, Even if you are not technically required to make a withdrawal, it may still make tax sense to. Here's what you need to know.

Rmd For 2025 Inherited Ira Kerri Dorette, Under this option, the inherited ira remains in. Inheriting an ira comes with tax implications.

Inherited Roth Ira Rmd Rules 2025 Chris Delcine, Here's what you need to know. Remember, the secure act changed stretch ira payments for most nonspouse.

2025 Rmd Calculator Inherited Ira Marjy Shannen, The irs seems committed to offering. More on this can be.

NonSpouse Beneficiaries Rules For An Inherited 401k Inherited ira, If you're not a spouse or an edb, then generally you must distribute all assets from the inherited ira within 10 years of the original owner's death. The irs has just waived some inherited ira rmds again for 2025.