The itc increased in amount and its timeline has been extended. One of the major expectations from the union budget 2025 is the rationalisation of the goods and services tax (gst) on solar equipment.

If you install solar panels in 2025 and then you decide to install more solar panels in 2025, you can claim the 30% itc again in 2025 because it’s a new tax year.

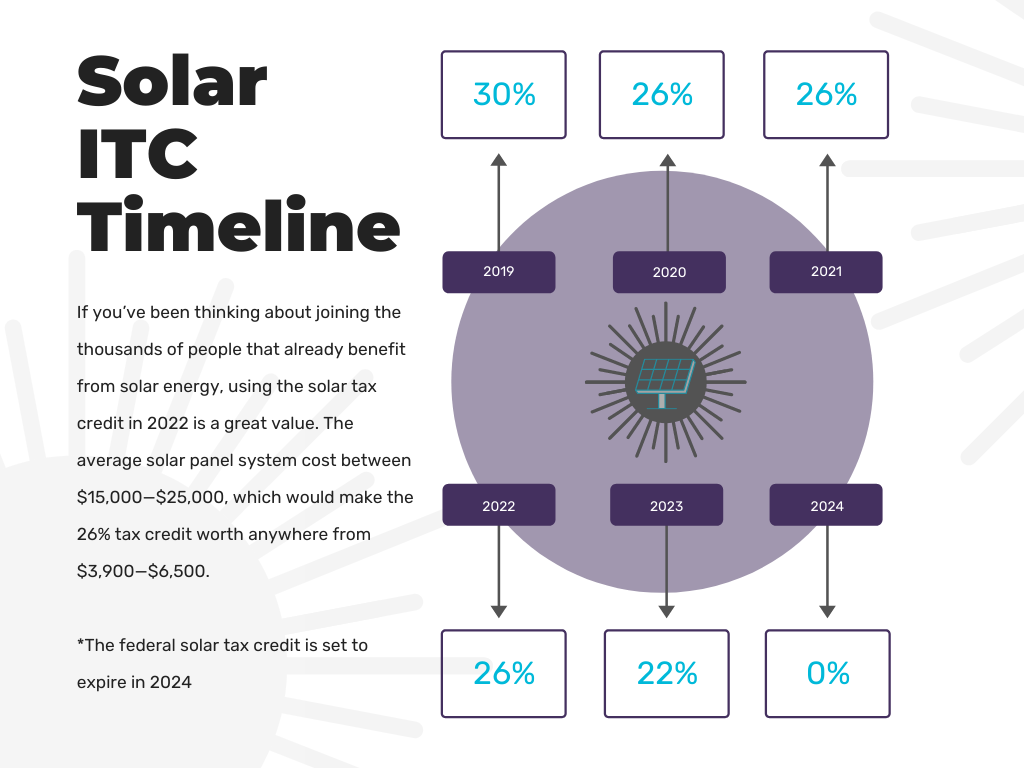

Proposed legislation to extend the investment credit tax (itc) would have a profound impact on the us solar industry, wood mackenzie analysis shows, potentially.

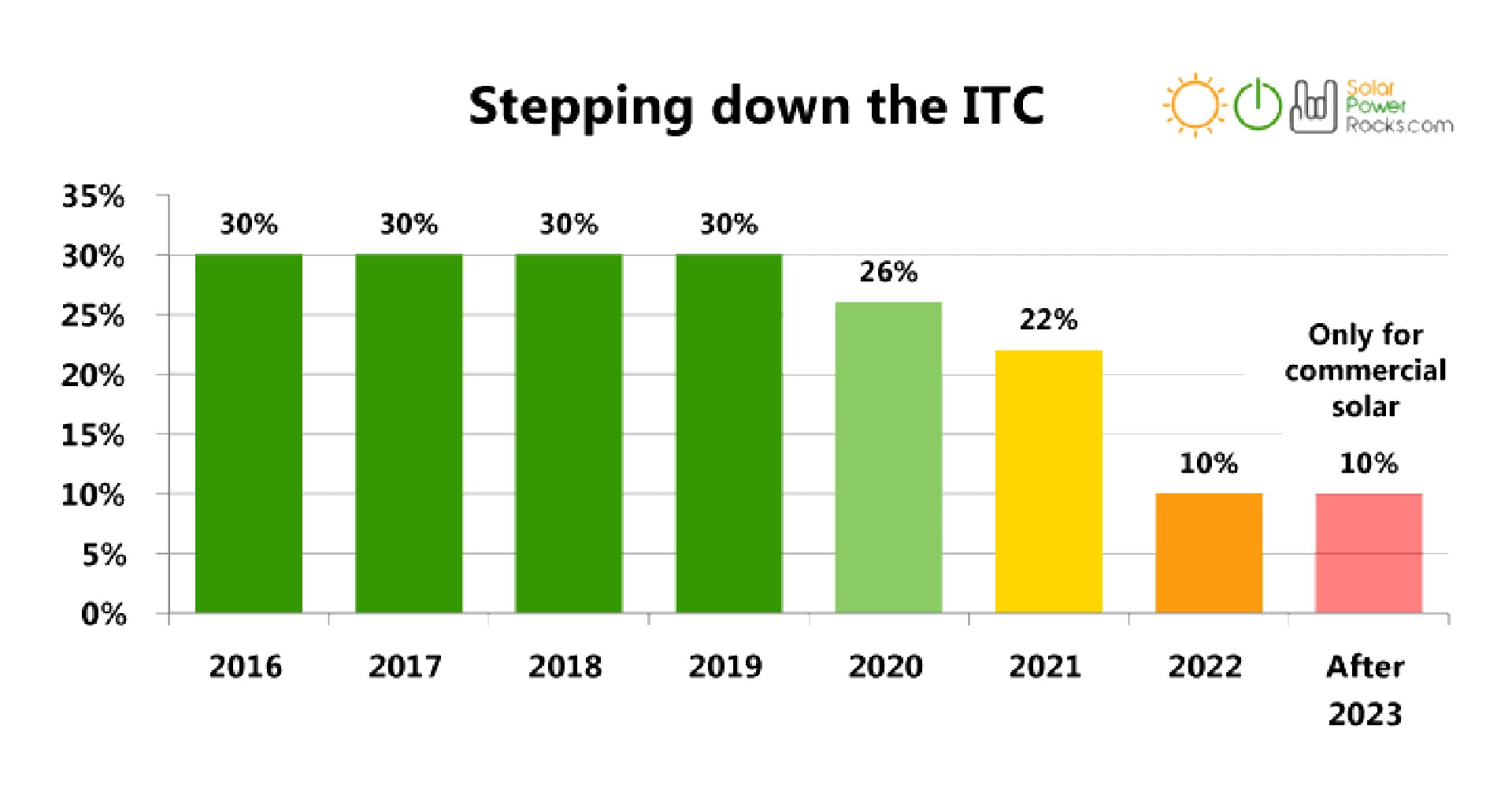

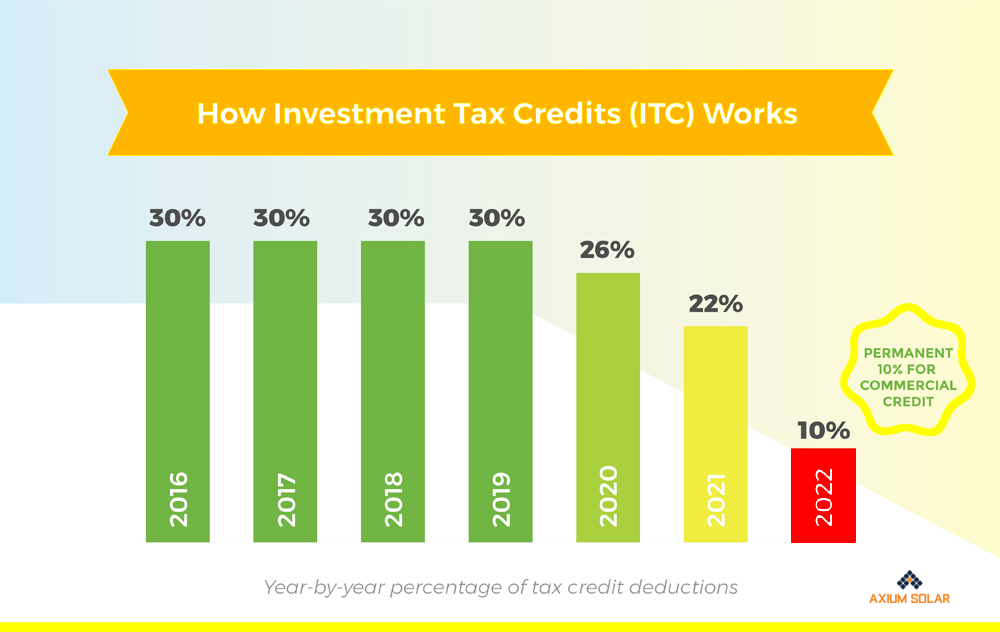

Federal Tax Credit For Installing Solar Panels Tax Walls, The solar itc is the primary financial incentive to go. The itc increased in amount and its timeline has been extended.

Federal Solar Tax Credits for Businesses Department of Energy, This tax credit allows homeowners. The itc increased in amount and its timeline has been extended.

How Do I Get My Solar Tax Rebate (or "ITC")? Omnidian Client Support, The itc solar tax credit is 30% through 2033 for qualified buyers. The federal solar investment tax credit (itc) offers a direct reduction in taxes owed as an incentive for installing a new solar energy system.

Solar Investment Tax Credit (Solar ITC) Explained Blog, India's solar capacity has grown significantly, reaching 84 gw by may 2025. The solar itc is the primary financial incentive to go.

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs, The itc is the federal policy which allows solar system owners to deduct some of their solar installation’s cost from their taxes. The residential clean energy credit, also known as the investment tax credit (itc), is a tax incentive worth 30% gross solar system cost.

Federal Investment Solar Tax Credit (Guide) Learn how to claim the, In 2025, the itc currently allows both homeowners and businesses to claim 30% of their solar system costs as a tax credit. Extending solar itc availability through 2034 at the elevated 30% rate promises to supercharge an already surging residential solar sector, allowing more families to.

What is the solar ITC (Investment Tax Credit)? Axium Solar, Fitch ratings has reviewed the ratings on 25 classes of seven solar mosaic abs. One key incentive is the 2025 federal solar credit.

What is The Solar Tax Credit Incentive? NV SOLAR RESIDENTIAL, The amount you can claim directly reduces the amount of tax you owe. One key incentive is the 2025 federal solar credit.

Commercial Solar Tax Benefits in California TENCO SOLAR, India's solar capacity has grown significantly, reaching 84 gw by may 2025. The itc solar tax credit is 30% through 2033 for qualified buyers.

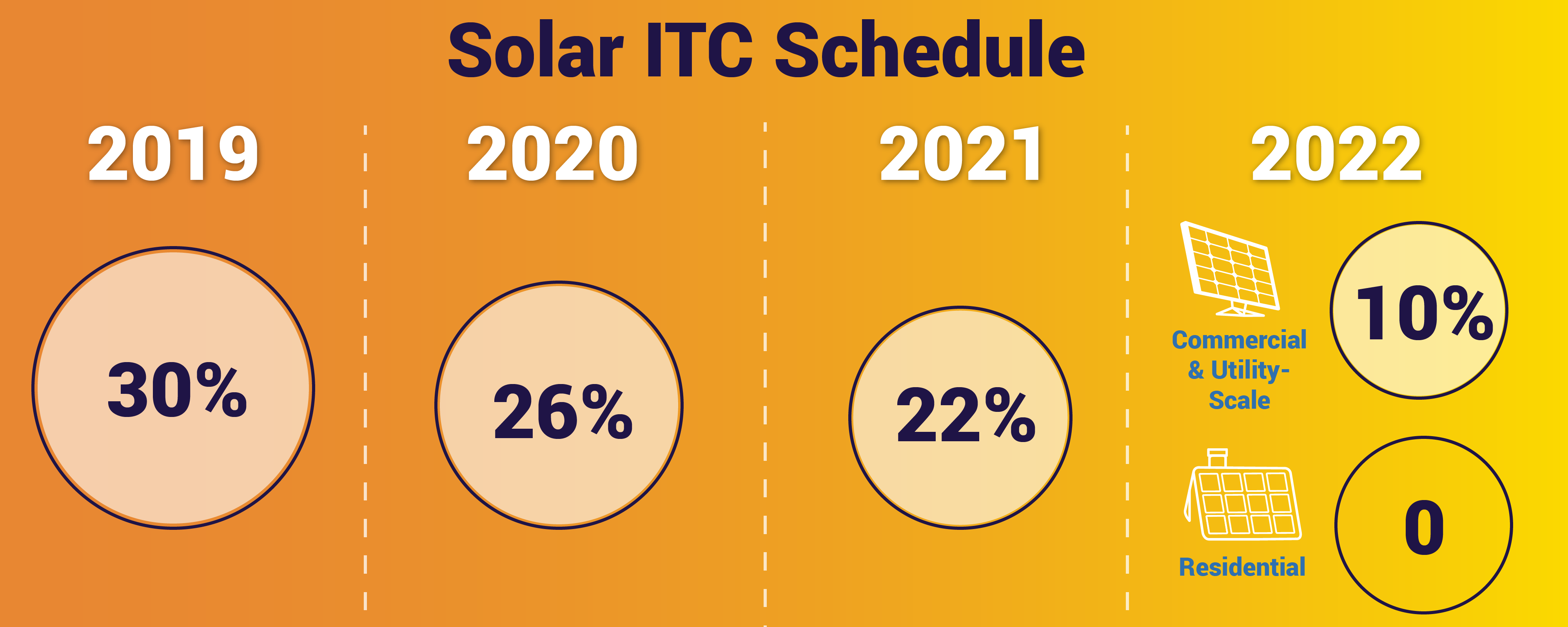

What You Need To Know About The ITC Solar Tax Credit Decreasing After, Find out more about the itc and. Department of commerce (doc) and the international trade commission.