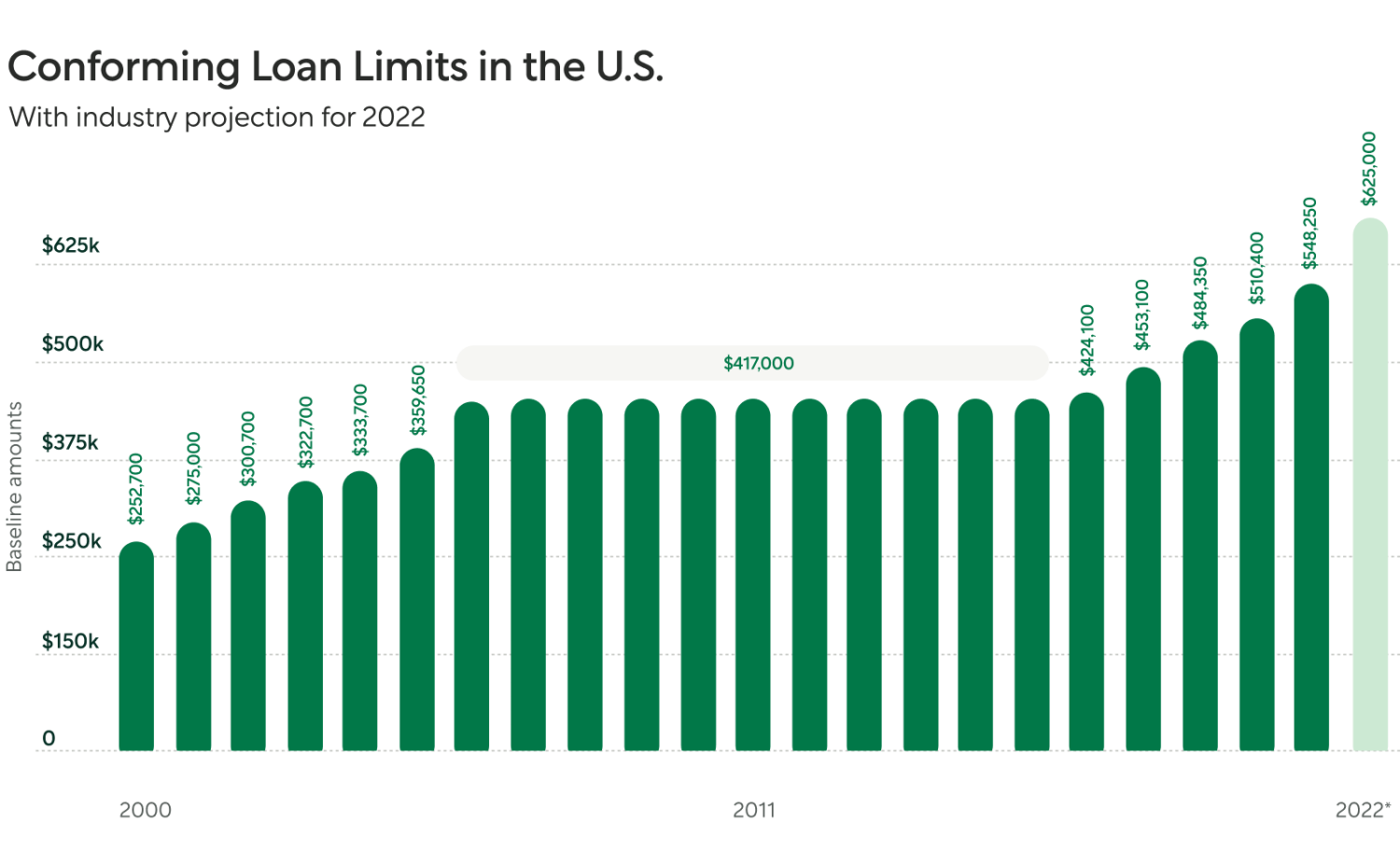

Conventional Loan Limit 2025. Will finance minister nirmala sitharaman increase income tax exemption limit? Conforming loan limits increase based on the fhfa’s house price index.

Fannie mae and freddie mac, sometimes referred to as government sponsored. For a conforming conventional loan, your loan must fall within the loan limits set by fannie mae and freddie mac.

Conforming Loan Limits Are Going Up Better Mortgage, The eligibility criteria for conventional conforming loans are set by fannie and freddie. Conforming loan limits, at their core, are used to separate conventional loans from jumbo loans.

What Is Conventional Conforming Loan, Will finance minister nirmala sitharaman increase income tax exemption limit? The federal housing finance agency (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae.

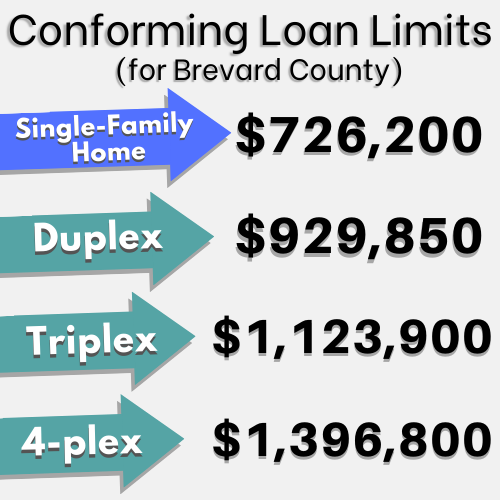

Conforming Loan Limits are Conventional Loan Limits, Conforming loan limits increase based on the fhfa’s house price index. To determine the loan limit in a particular area, the fhfa.

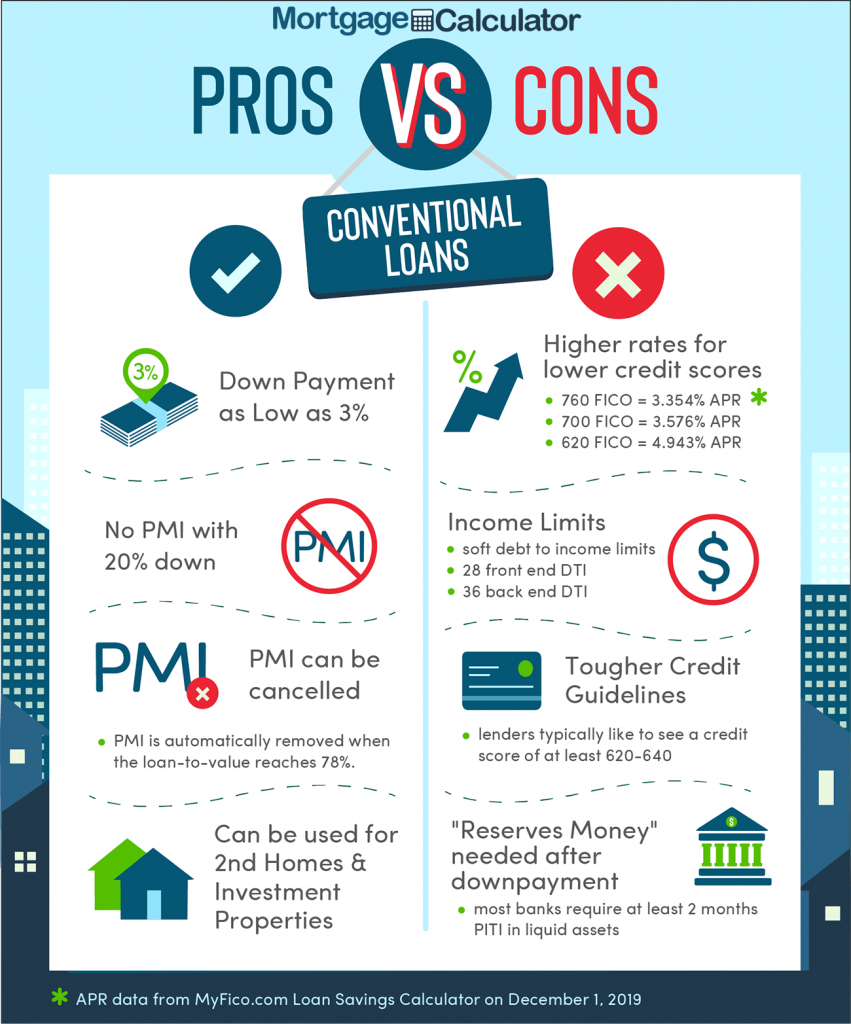

Conventional Loan, You might qualify for an fha loan with a credit score of 500 to 579 with a 10% down payment. Multiply your total annual interest ($4,200) by the portion of your loan it.

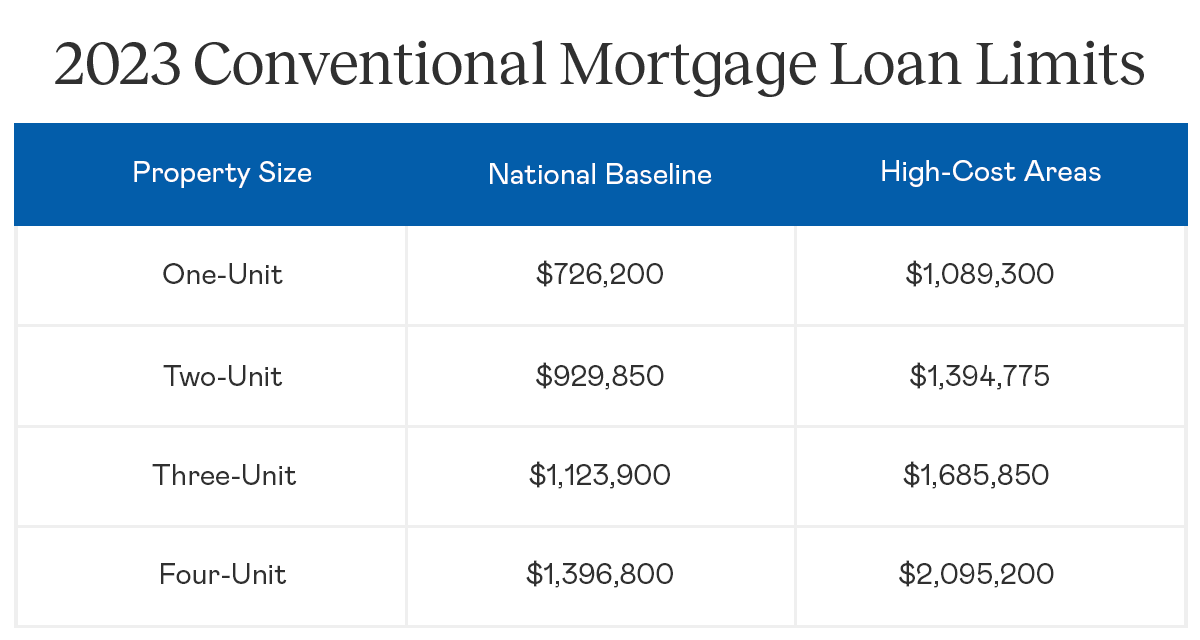

Information About Conventional Mortgages, Special statutory provisions establish different loan limits for. The projected increase in 2025 is approximately 3.28%, resulting in a new conforming loan limit of $750,000, up from $726,200 in 2025.

LOAN LIMIT INCREASE FOR CONVENTIONAL LOANS.pdf PDF Host, Conforming loan limits increase based on the fhfa’s house price index. A loan limit is a maximum amount a person can borrow.

FHA Loans vs. Conventional Loans What’s the Difference?, Special statutory provisions establish different loan limits for. The eligibility criteria for conventional conforming loans are set by fannie and freddie.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Conv loan limits hacscott, Conforming loan limits increase based on the fhfa’s house price index. In 2025, you can borrow up to $766,550 on a conforming loan in most areas, marking a conforming loan limit increase of $40,350 from last year's numbers.

Conventional Loan Requirements in 2025 Coole Home, All signs point to the federal housing finance agency ( fhfa) increasing the conforming loan limit from $726,200 in 2025 to $750,000 in 2025. In budget 2025, motilal believes that the new government.

2025 Increase to Conventional Loan Limits, Conforming loan limits increase based on the fhfa’s house price index. As home prices rise, so do the limits.

The federal housing finance agency (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae.